- Referenda/

- Medium Spender/

- #833/

Referendum #833

VIRTUNE AB X POLKADOT - ETP CAMPAIGN, SWEDEN & THE NORDICS

Executed

Content

AI Summary

Translations

This is a proposal presented by CultureDot on behalf of Virtune AB — a fully regulated, Digital Asset Manager licensed to operate in multiple Nordic countries. This campaign serves to promote exposure of a 1:1 Spot Backed, Polkadot ETP, issued by Virtune AB.

**VIRTUNE X POLKADOT - ETP CAMPAIGN, SWEDEN & THE NORDICS

**Presented by CultureDot for Virtune AB

Message from the Company:

Virtune is a fast growing asset manager and issuer of crypto exchange-traded products in the Nordics with the aim to drive adoption of a regulated, Nasdaq-listed and FSA compliant Staked Polkadot ETP. Using selective marketing strategies, our 100% physically backed spot Staked Polkadot product will be presented to both retail and institutional investors alike.

_With this referendum, Virtune plans to address demand in the Nordic financial markets that are currently underserved and greatly increase the number of investors who choose to invest into this vibrant new technology. Polkadot.” - Christopher Kock, CEO Virtune AB

_

TABLE OF CONTENTS

Proposal

Campaign

Events & Appearances

The Ask (Budget)

Targets & KPI’s

Analytics

ETP Information & FAQ

Letter from the Proposer (CultureDot)

Conclusions & Next Steps

Community Notes

**THE PROPOSAL

**The Digital Asset landscape is quickly maturing and the appetite for exposure is steadily climbing throughout 2024. The emergence of crypto backed, traditional financial products grant access to an entirely new demographic of investors who previously did not have the technical aptitude or risk appetite for gaining exposure to spot crypto holdings.

Virtune presents a unique opportunity to expand investor interest in Polkadot by offering a direct, fully regulated, investible staked, spot backed ETP.

A few attributes that make Virtune a clear contender in the Digital Asset management space:

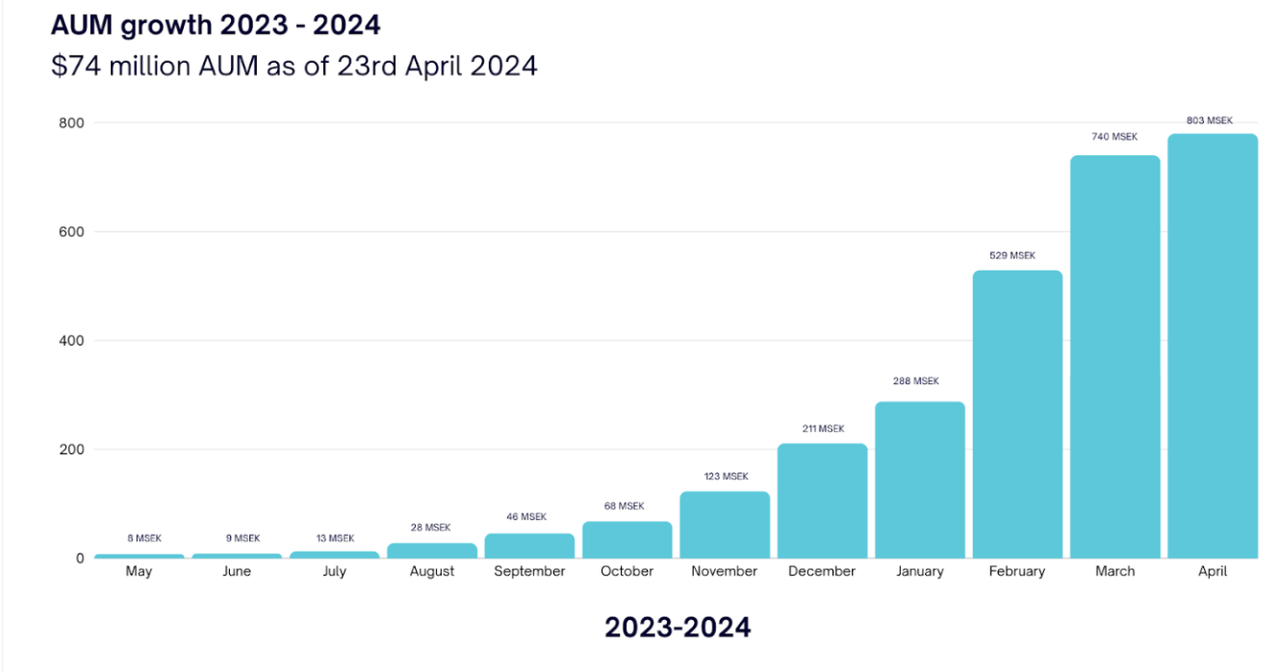

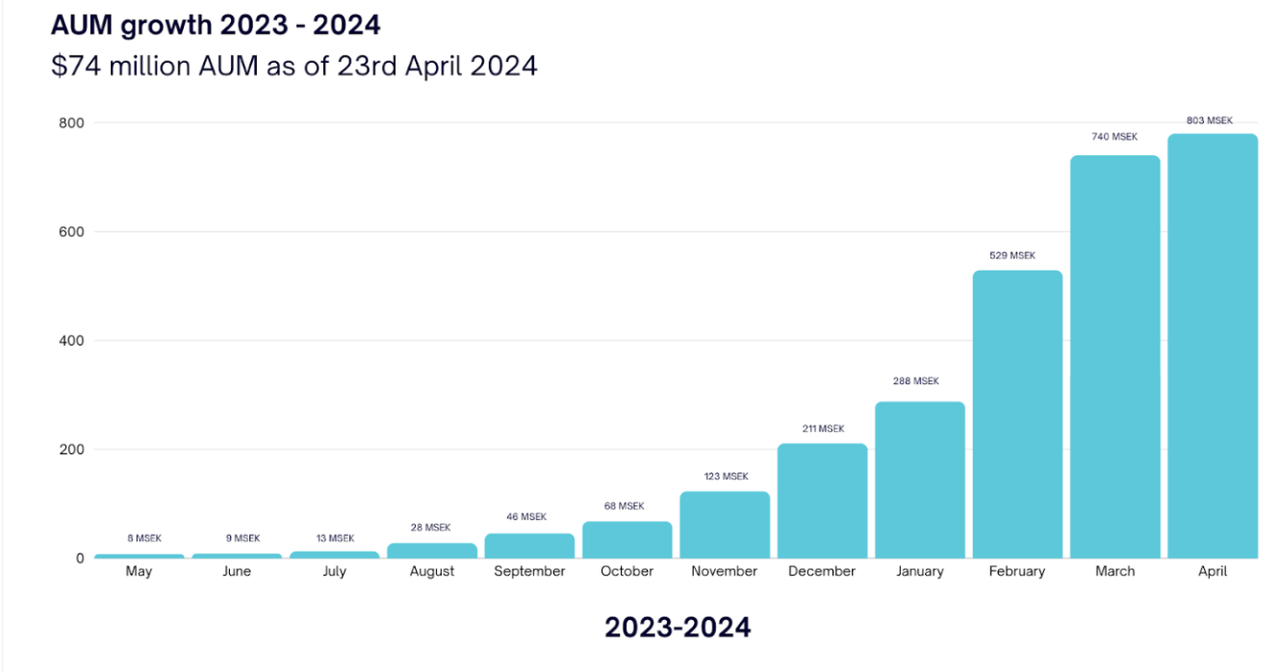

— 89M in assets under management

— 26,000 unique accounts

— Publicly traded on the Nasdaq Nordic & eligible to residents of Sweden, Norway, Denmark, Finland, Iceland, Estonia, Latvia, Lithuania & Germany.

— Fully registered with the FSA (Financial Supervisory Authority) of Sweden

— Products available direct through traditional finance platforms and banks

— Team of 12 professionals dedicated to growing Virtune as the #1 leading crypto asset manager in the Nordics

— Investor base comprising of DOT, BTC, ETH, LINK, ARB, MATIC & SOL ETP holders

Company Partners:

— Coinbase: Custodian and Storage of Funds

— Formidium: Fund Administrator

— Nordic Issuing Services: ETP Issuing Agent & Clearing House

— Flow Traders: Market Maker

— Ultumus: ETP Calculation Agency

— Vinter: Index and Reference Rate for up to Date ETP Pricing

— Jane Street: Authorized Participant and Liquidity Provider

— Figment - Staking Provider

Brokerage Platforms:

— Avanza: 1.93M investors

— Nordnet: 1.862M investors

— Handelsbanken: Largest bank in Sweden handling local & international business accounts with 214 regional offices

— Strivo: One of the largest financial advisor platforms with over 120 advisors for alternative investments within Sweden - managing over 2.5B USD

— Pareto Securities - Independent, full service investment bank

— Kvarn X Trading Platform (Coming Soon)

Virtune Products are listed on the Nordic Nasdaq - home to over 680 companies with an average trading volume of 3.2B and a Market Cap of 1.95 Trillion. Nasdaq Stockholm is the largest stock exchange in the region and one of the largest stock exchanges in Europe that can also be accessed globally. This enables the Virtune products to be accessed by a large number of investors in multiple markets, an angle that will be incorporated to this campaign through various methods presented below.

**THE CAMPAIGN

**In order to reach the maximum number of prospects while also creating the most impact - we planned a multi-channel approach, which will consist of digital advertisements, IRL placements, select appearances and private seminars which will be held at the Virtune office.

**Digital

— Direct targeting of existing Virtune ETP investors via email campaigns, direct messages & newsletters

— Press releases with financial platforms such as Swedbank, Avanza & related institutions, which reach a large number of relevant, active investors

— Digital placements across major finance websites in Sweden

— Social Media placements across relevant financial profiles & KOL's

— Podcasts & Appearances

— A press release announcing the collaboration between the Polkadot Treasury and Virtune which will be simultaneously distributed across several markets and shared with multiple journalists in the Nordic region.

**

Total number of Impressions amount to approx 4.5M for this part of the campaign

**Virtune AB will fund the digital spend portion of the campaign, matching 20% of the IRL hard cost, amounting to a total of $78,660 USD

**

IRL

The IRL part of the advertising campaign will target an audience of working professionals, residents and travelers living, working and transiting within Sweden and eligible jurisdictions. The activations will be specifically targeted towards relevant areas of Stockholm Transit & City Center.

We have contacted 4 separate agencies to fulfill the requests of this large-scale campaign. Resources will be deployed to cover placements in the following areas:

**Arlanda Express Train

**Connects Stockholm International Airport to Stockholm Central Station

**Street & City Transit Placement

**A Selected Group of Transit Stations Around the City Center

**“Stockholm Wall St.” Regeringsgatan / Jakobsbergsgatan

**Stockholm Financial District & High-End Shopping Area

**City Centre Stockholm

**NK, Mood Mall, Sergels Torg, and NK Vepa

**Total number of Impressions amount to approx 12.4M for this part of the campaign

**IRL Placements Full Specifications & Media Sheet - https://drive.google.com/file/d/1_tn3CI4vyZZMuL3mwu8WO4CW0m4V3S2s/view?usp=drive_link

IRL Placements Mock Schedule (subject to change based on availability) - https://drive.google.com/file/d/1Y4O6nC6YTnymPReIxz03Detzw_M4N9Mz/view?usp=drive_link

**

EVENTS & APPEARANCES**

Virtune will hold multiple in-person seminars at their head office, presenting the Polkadot ETP. The target will be to attract a minimum of 50 attendees for each event - consisting of private banking advisors and professionals from some of the largest banks in Sweden and the Nordics regions.

A member from within the Polkadot community will be scheduled to attend one or more of the Virtune events and present to the attendees the current happenings within the Polkadot network. This representative will be chosen by the Distractive Polkadot Marketing team.

Christopher Kock, CEO will present the Polkadot ETP during appearances scheduled on financial channels, placing extra emphasis on the product as a viable investment.

Reference to Past Channel Appearances

Nasdaq TradeTalks: https://www.youtube.com/watch?v=WkRX0Nqwyz0

DiTV: https://www.di.se/ditv/borskoll/experten-darfor-rusar-krypto/

THE ASK

We are requesting a total of 89,945 DOT ($571,150 USD) at a price of $6.35 (MA 200 & BINANCE WEEKLY MA 100) to cover the following:

— AD Campaign (Airport Express & Transit) - 46,966

— AD Campaign (City Centre) - 31,310

— AD Campaign (Digital) - Funded by Virtune

— Graphic Design - 3513

— Polkadot Seminar Representative - 1260

— Incidentals / Misc - 1694

— Agency Fee - 5202

Virtune AB will fund the digital spend portion of the campaign, matching 20% of the IRL hard cost, amounting to a total of $78,660 USD

Any funds sold above the price of $6.35 will be returned to the treasury Any funds sold below the price of $6.35 the IRL portion will be slightly shortened

We have decided to request DOT even though the new USDT / USDC option is available as we are comfortable operating with this tested & tried method at the moment.

**TARGETS / KPI’s

**The campaign is projected to attract 2830 new clients to invest in the Polkadot ETP, with an average starting investment of $1750 per investor.

By early 2025, we expect the campaign to achieve a ROI of $4.4M into the Polkadot ecosystem (via VIRDOT ETP) equivalent to approx 631K DOT tokens, based on the current DOT price of $6.97.

The above numbers are calculated based on Virtune's historical metrics from the past 11 months, during which more than 26,000 investors were organically reached.

Beyond the immediate results, this campaign is expected to create a ripple effect, attracting more investors to Polkadot over time and instilling interest from private firms & institutions from the Nordic regions

**

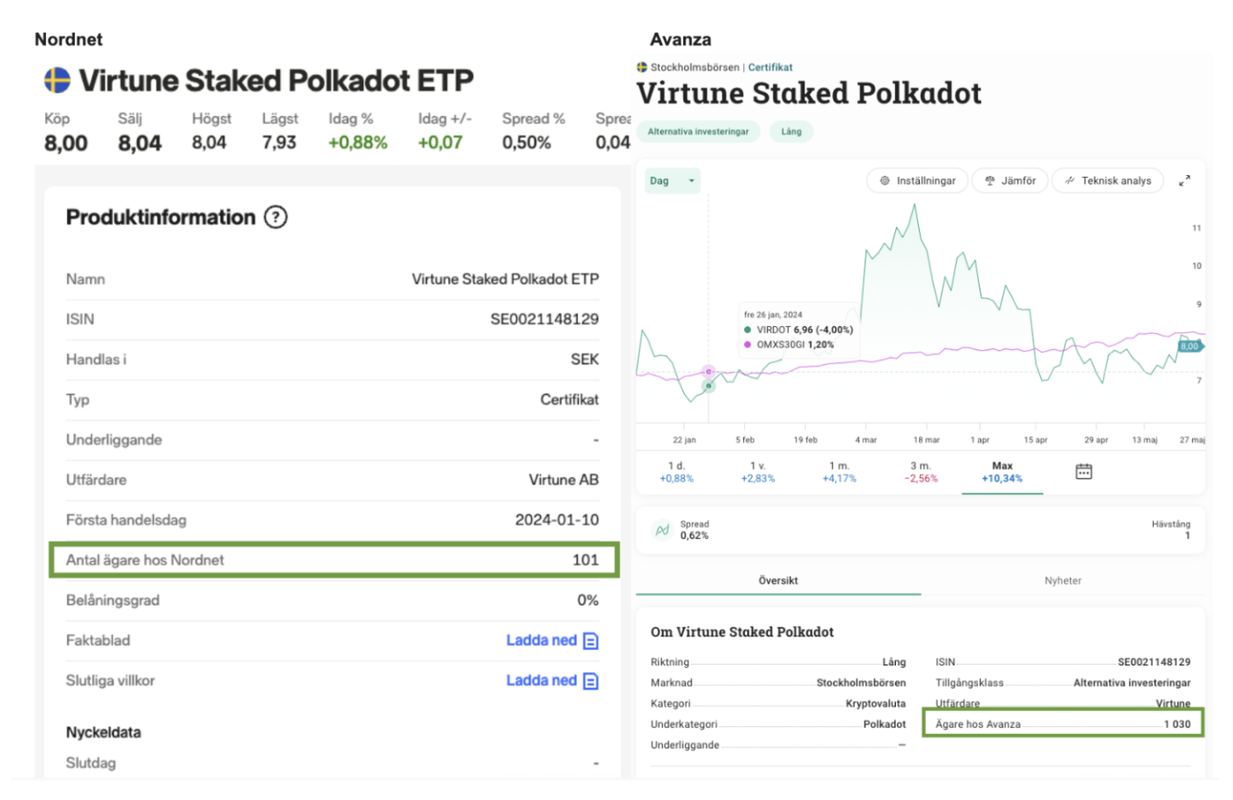

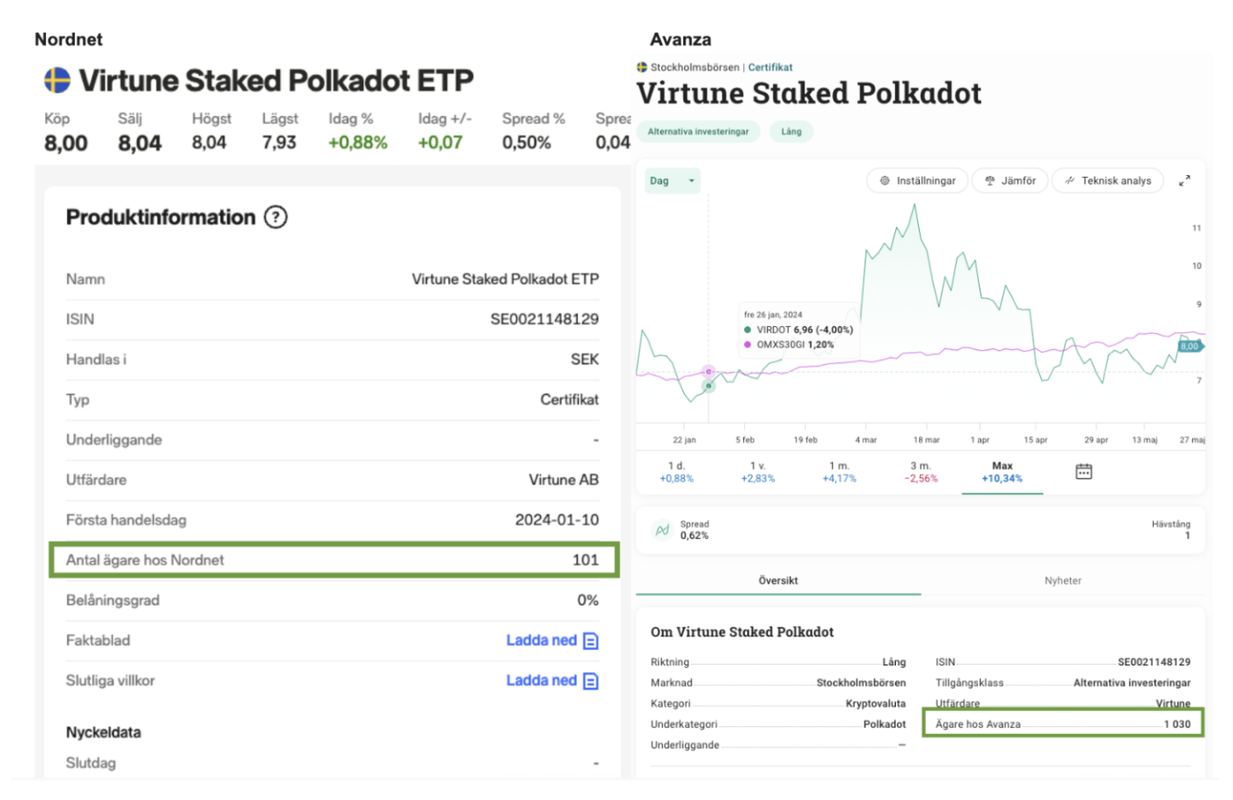

ANALYTICS & TRACKING**

More than 90% of the investments are expected to be made through Nordnet and Avanza which are the biggest platforms in the Nordics. These platforms are being updated on a daily basis and the metrics can easily be tracked by anyone following the progress of this campaign.

Avanza Data: https://www.avanza.se/borshandlade-produkter/certifikat-torg/om-certifikatet.html/1694757/virtune-staked-polkadot

Nordnet Data: https://www.nordnet.se/marknaden/trackers/18216585-virtune-staked-polkadot

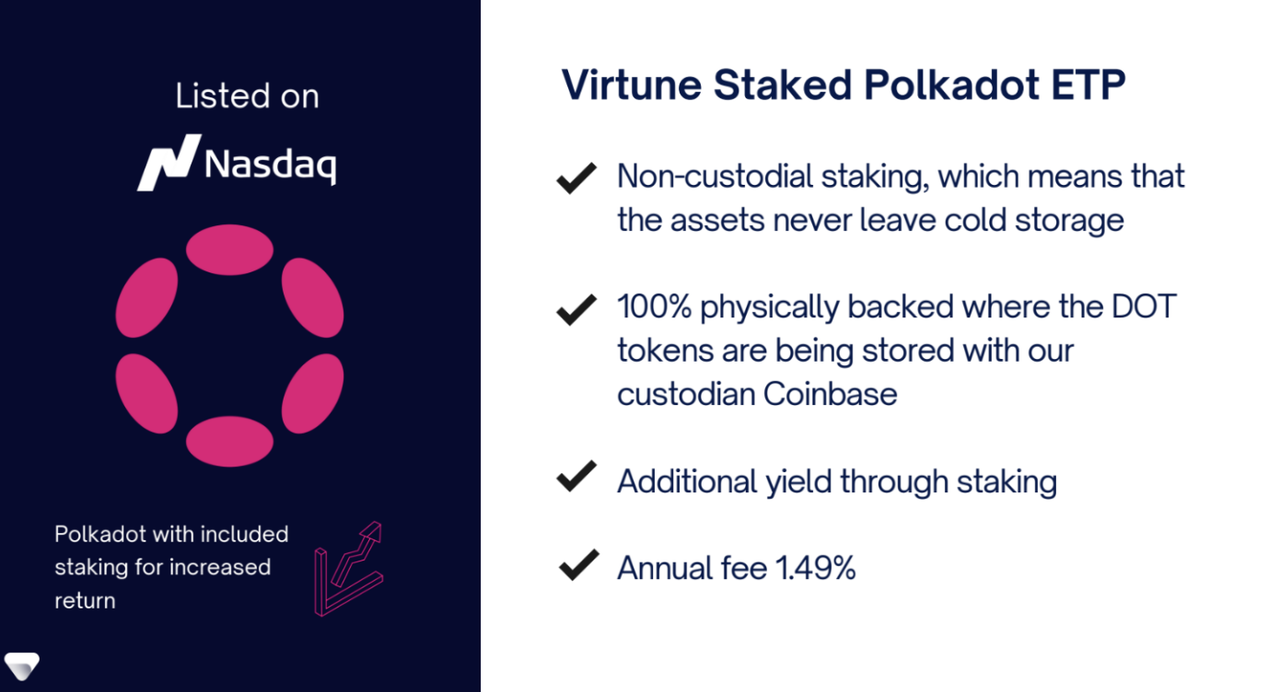

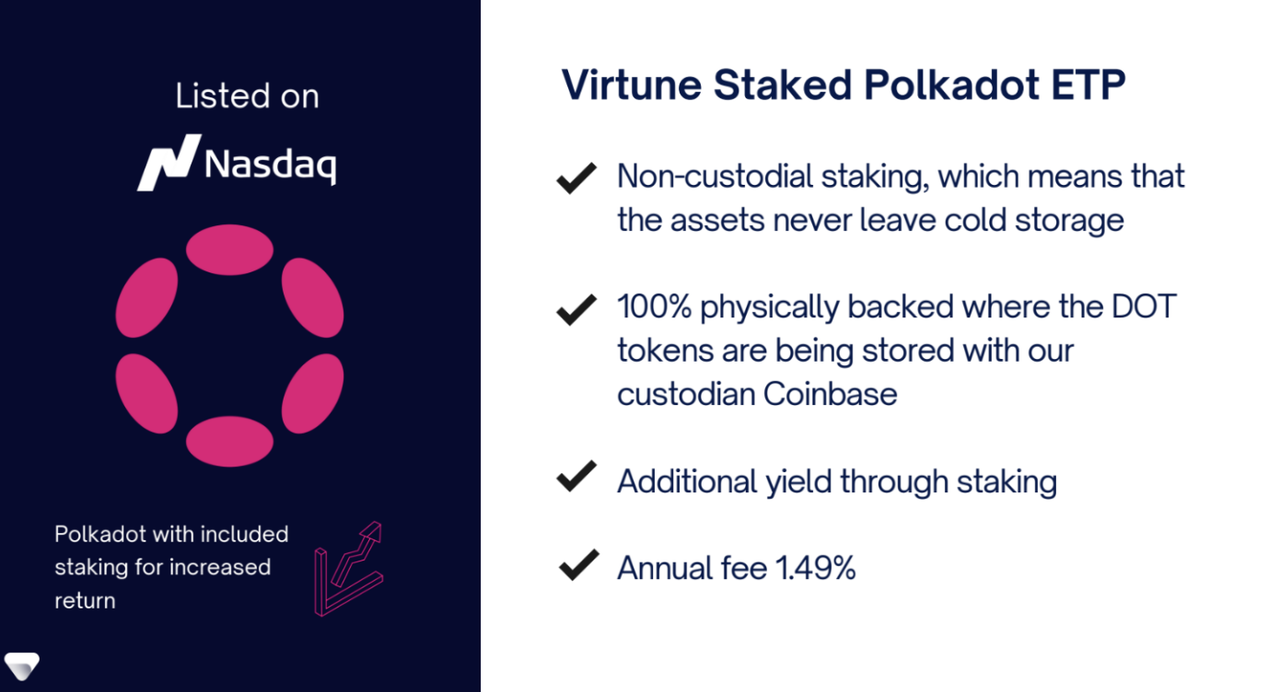

VIRTUNE POLKADOT STAKED ETP - INFORMATION & FAQ

The Virtune Staked Polkadot ETP was listed on Nasdaq Stockholm OMX's regulated market on January 10, 2024. This product is fully backed by spot DOT tokens, which are securely stored with Virtune's custodian, Coinbase. The tokens are staked directly from cold storage, with the rewards continuously accruing to the product. This process enhances the ETP's performance, as investors receive these rewards.

Currently, the annual staking return for investors stands at 4% on top of Polkadot’s performance. This staking yield is due to our strategy of not staking all of our holdings, maintaining liquidity to ensure that investors can freely buy and sell the product at any time during market hours without any lockup period.

Why do investors prefer to invest in Polkadot through an ETP instead of using crypto exchanges?

The most significant advantage of investing in Polkadot through an ETP in Sweden is the ability to store it in an ISK account, where you pay a standard annual tax of 1.25% instead of the 30% capital gains tax. This benefit makes it a clear first choice for investors. Additionally, most investors prefer to hold their cryptocurrency investments in their traditional securities accounts, eliminating the need to declare transactions or use a separate cryptocurrency exchange or account.

The combination of these values make our product a very attractive investment and we plan to grow the demand of this product with the above mentioned strategy - which we believe will be a net positive spend for the Polkadot Network.

**

A MESSAGE FROM THE PROPOSER (CULTUREDOT)**

This project with Virtune marks our first collaboration with a regulated Digital Asset Manager - with a campaign directly focused on a 1:1 spot backed ETP.

Through this investment, the Polkadot Network will be exposed to major banks, market makers, trading platforms and regulatory bodies - all of which help the growth & attention of Polkadot as a leader in the space.

We have spent the past 3 months working directly with Virtune to outline the concepts & deliverables presented above. We fully support the endeavors herein put forth by Virtune to spark further adoption of digital assets in the Nordics, and more specifically, Polkadot.

Thank you for your consideration.

Sincerely,

CultureDot / Virtune AB

**CONCLUSION & NEXT STEPS

**Upon approval of this proposal, funds will immediately be converted to SEK (Swedish Krona) / EUR to pay vendors for their services.

For any reason the project does not move forward, distributed funds will be returned to the treasury where applicable.

COMMUNITY NOTES

Virtune Website - https://www.virtune.com/en/

Virtune Polkadot ETP - https://www.virtune.com/en/product/polkadot/

Virtune Polkadot ETP Fact Sheet - https://storage.googleapis.com/virtune-public-bucket/virdot/documents/factsheet-en.pdf

Virtune Polkadot ETP Key Information Document - https://storage.googleapis.com/virtune-public-bucket/virdot/documents/kid-en.pdf

Virtune X Polkadot Projects Folder: https://drive.google.com/drive/folders/1OzMCG7sO2jPXAUb0fxXEC4pPFotltfZ0?usp=drive_link

Virtune ID - 14ifrZHi32zA34vYpnVwLXWxArk2EiaMRxdKVu5HVRPdqLii

(Deposit Address)

Proposer ID - 15wuStiU3csCRdJgbztubxFFSpsdhRApUzmKWtBderKtd43G

(CultureDot Address)

Virtune AB, a regulated Digital Asset Manager, has partnered with CultureDot to promote a Polkadot ETP (Exchange-Traded Product) in the Nordic region. This 1:1 Spot Backed Polkadot ETP aims to increase investment in Polkadot by offering a regulated, investible staked, spot-backed ETP. Virtune AB is a fast-growing asset manager with 89M in assets under management and 26,000 unique accounts. They are publicly traded on the Nasdaq Nordic and are registered with the FSA of Sweden. The campaign includes digital advertisements, IRL placements, select appearances, and private seminars to reach retail and institutional investors. The goal is to attract 2830 new clients with an average starting investment of $1750 per investor, expecting a ROI of $4.4M into the Polkadot ecosystem by early 2025. Virtune AB will fund the digital spend portion of the campaign, matching 20% of the IRL hard cost, amounting to a total of $78,660 USD.

Source

This is a proposal presented by CultureDot on behalf of Virtune AB — a fully regulated, Digital Asset Manager licensed to operate in multiple Nordic countries. This campaign serves to promote exposure of a 1:1 Spot Backed, Polkadot ETP, issued by Virtune AB.

**VIRTUNE X POLKADOT - ETP CAMPAIGN, SWEDEN & THE NORDICS

**Presented by CultureDot for Virtune AB

Message from the Company:

Virtune is a fast growing asset manager and issuer of crypto exchange-traded products in the Nordics with the aim to drive adoption of a regulated, Nasdaq-listed and FSA compliant Staked Polkadot ETP. Using selective marketing strategies, our 100% physically backed spot Staked Polkadot product will be presented to both retail and institutional investors alike.

_With this referendum, Virtune plans to address demand in the Nordic financial markets that are currently underserved and greatly increase the number of investors who choose to invest into this vibrant new technology. Polkadot.” - Christopher Kock, CEO Virtune AB

_

TABLE OF CONTENTS

Proposal

Campaign

Events & Appearances

The Ask (Budget)

Targets & KPI’s

Analytics

ETP Information & FAQ

Letter from the Proposer (CultureDot)

Conclusions & Next Steps

Community Notes

**THE PROPOSAL

**The Digital Asset landscape is quickly maturing and the appetite for exposure is steadily climbing throughout 2024. The emergence of crypto backed, traditional financial products grant access to an entirely new demographic of investors who previously did not have the technical aptitude or risk appetite for gaining exposure to spot crypto holdings.

Virtune presents a unique opportunity to expand investor interest in Polkadot by offering a direct, fully regulated, investible staked, spot backed ETP.

A few attributes that make Virtune a clear contender in the Digital Asset management space:

— 89M in assets under management

— 26,000 unique accounts

— Publicly traded on the Nasdaq Nordic & eligible to residents of Sweden, Norway, Denmark, Finland, Iceland, Estonia, Latvia, Lithuania & Germany.

— Fully registered with the FSA (Financial Supervisory Authority) of Sweden

— Products available direct through traditional finance platforms and banks

— Team of 12 professionals dedicated to growing Virtune as the #1 leading crypto asset manager in the Nordics

— Investor base comprising of DOT, BTC, ETH, LINK, ARB, MATIC & SOL ETP holders

Company Partners:

— Coinbase: Custodian and Storage of Funds

— Formidium: Fund Administrator

— Nordic Issuing Services: ETP Issuing Agent & Clearing House

— Flow Traders: Market Maker

— Ultumus: ETP Calculation Agency

— Vinter: Index and Reference Rate for up to Date ETP Pricing

— Jane Street: Authorized Participant and Liquidity Provider

— Figment - Staking Provider

Brokerage Platforms:

— Avanza: 1.93M investors

— Nordnet: 1.862M investors

— Handelsbanken: Largest bank in Sweden handling local & international business accounts with 214 regional offices

— Strivo: One of the largest financial advisor platforms with over 120 advisors for alternative investments within Sweden - managing over 2.5B USD

— Pareto Securities - Independent, full service investment bank

— Kvarn X Trading Platform (Coming Soon)

Virtune Products are listed on the Nordic Nasdaq - home to over 680 companies with an average trading volume of 3.2B and a Market Cap of 1.95 Trillion. Nasdaq Stockholm is the largest stock exchange in the region and one of the largest stock exchanges in Europe that can also be accessed globally. This enables the Virtune products to be accessed by a large number of investors in multiple markets, an angle that will be incorporated to this campaign through various methods presented below.

**THE CAMPAIGN

**In order to reach the maximum number of prospects while also creating the most impact - we planned a multi-channel approach, which will consist of digital advertisements, IRL placements, select appearances and private seminars which will be held at the Virtune office.

**Digital

— Direct targeting of existing Virtune ETP investors via email campaigns, direct messages & newsletters

— Press releases with financial platforms such as Swedbank, Avanza & related institutions, which reach a large number of relevant, active investors

— Digital placements across major finance websites in Sweden

— Social Media placements across relevant financial profiles & KOL's

— Podcasts & Appearances

— A press release announcing the collaboration between the Polkadot Treasury and Virtune which will be simultaneously distributed across several markets and shared with multiple journalists in the Nordic region.

**

Total number of Impressions amount to approx 4.5M for this part of the campaign

**Virtune AB will fund the digital spend portion of the campaign, matching 20% of the IRL hard cost, amounting to a total of $78,660 USD

**

IRL

The IRL part of the advertising campaign will target an audience of working professionals, residents and travelers living, working and transiting within Sweden and eligible jurisdictions. The activations will be specifically targeted towards relevant areas of Stockholm Transit & City Center.

We have contacted 4 separate agencies to fulfill the requests of this large-scale campaign. Resources will be deployed to cover placements in the following areas:

**Arlanda Express Train

**Connects Stockholm International Airport to Stockholm Central Station

**Street & City Transit Placement

**A Selected Group of Transit Stations Around the City Center

**“Stockholm Wall St.” Regeringsgatan / Jakobsbergsgatan

**Stockholm Financial District & High-End Shopping Area

**City Centre Stockholm

**NK, Mood Mall, Sergels Torg, and NK Vepa

**Total number of Impressions amount to approx 12.4M for this part of the campaign

**IRL Placements Full Specifications & Media Sheet - https://drive.google.com/file/d/1_tn3CI4vyZZMuL3mwu8WO4CW0m4V3S2s/view?usp=drive_link

IRL Placements Mock Schedule (subject to change based on availability) - https://drive.google.com/file/d/1Y4O6nC6YTnymPReIxz03Detzw_M4N9Mz/view?usp=drive_link

**

EVENTS & APPEARANCES**

Virtune will hold multiple in-person seminars at their head office, presenting the Polkadot ETP. The target will be to attract a minimum of 50 attendees for each event - consisting of private banking advisors and professionals from some of the largest banks in Sweden and the Nordics regions.

A member from within the Polkadot community will be scheduled to attend one or more of the Virtune events and present to the attendees the current happenings within the Polkadot network. This representative will be chosen by the Distractive Polkadot Marketing team.

Christopher Kock, CEO will present the Polkadot ETP during appearances scheduled on financial channels, placing extra emphasis on the product as a viable investment.

Reference to Past Channel Appearances

Nasdaq TradeTalks: https://www.youtube.com/watch?v=WkRX0Nqwyz0

DiTV: https://www.di.se/ditv/borskoll/experten-darfor-rusar-krypto/

THE ASK

We are requesting a total of 89,945 DOT ($571,150 USD) at a price of $6.35 (MA 200 & BINANCE WEEKLY MA 100) to cover the following:

— AD Campaign (Airport Express & Transit) - 46,966

— AD Campaign (City Centre) - 31,310

— AD Campaign (Digital) - Funded by Virtune

— Graphic Design - 3513

— Polkadot Seminar Representative - 1260

— Incidentals / Misc - 1694

— Agency Fee - 5202

Virtune AB will fund the digital spend portion of the campaign, matching 20% of the IRL hard cost, amounting to a total of $78,660 USD

Any funds sold above the price of $6.35 will be returned to the treasury Any funds sold below the price of $6.35 the IRL portion will be slightly shortened

We have decided to request DOT even though the new USDT / USDC option is available as we are comfortable operating with this tested & tried method at the moment.

**TARGETS / KPI’s

**The campaign is projected to attract 2830 new clients to invest in the Polkadot ETP, with an average starting investment of $1750 per investor.

By early 2025, we expect the campaign to achieve a ROI of $4.4M into the Polkadot ecosystem (via VIRDOT ETP) equivalent to approx 631K DOT tokens, based on the current DOT price of $6.97.

The above numbers are calculated based on Virtune's historical metrics from the past 11 months, during which more than 26,000 investors were organically reached.

Beyond the immediate results, this campaign is expected to create a ripple effect, attracting more investors to Polkadot over time and instilling interest from private firms & institutions from the Nordic regions

**

ANALYTICS & TRACKING**

More than 90% of the investments are expected to be made through Nordnet and Avanza which are the biggest platforms in the Nordics. These platforms are being updated on a daily basis and the metrics can easily be tracked by anyone following the progress of this campaign.

Avanza Data: https://www.avanza.se/borshandlade-produkter/certifikat-torg/om-certifikatet.html/1694757/virtune-staked-polkadot

Nordnet Data: https://www.nordnet.se/marknaden/trackers/18216585-virtune-staked-polkadot

VIRTUNE POLKADOT STAKED ETP - INFORMATION & FAQ

The Virtune Staked Polkadot ETP was listed on Nasdaq Stockholm OMX's regulated market on January 10, 2024. This product is fully backed by spot DOT tokens, which are securely stored with Virtune's custodian, Coinbase. The tokens are staked directly from cold storage, with the rewards continuously accruing to the product. This process enhances the ETP's performance, as investors receive these rewards.

Currently, the annual staking return for investors stands at 4% on top of Polkadot’s performance. This staking yield is due to our strategy of not staking all of our holdings, maintaining liquidity to ensure that investors can freely buy and sell the product at any time during market hours without any lockup period.

Why do investors prefer to invest in Polkadot through an ETP instead of using crypto exchanges?

The most significant advantage of investing in Polkadot through an ETP in Sweden is the ability to store it in an ISK account, where you pay a standard annual tax of 1.25% instead of the 30% capital gains tax. This benefit makes it a clear first choice for investors. Additionally, most investors prefer to hold their cryptocurrency investments in their traditional securities accounts, eliminating the need to declare transactions or use a separate cryptocurrency exchange or account.

The combination of these values make our product a very attractive investment and we plan to grow the demand of this product with the above mentioned strategy - which we believe will be a net positive spend for the Polkadot Network.

**

A MESSAGE FROM THE PROPOSER (CULTUREDOT)**

This project with Virtune marks our first collaboration with a regulated Digital Asset Manager - with a campaign directly focused on a 1:1 spot backed ETP.

Through this investment, the Polkadot Network will be exposed to major banks, market makers, trading platforms and regulatory bodies - all of which help the growth & attention of Polkadot as a leader in the space.

We have spent the past 3 months working directly with Virtune to outline the concepts & deliverables presented above. We fully support the endeavors herein put forth by Virtune to spark further adoption of digital assets in the Nordics, and more specifically, Polkadot.

Thank you for your consideration.

Sincerely,

CultureDot / Virtune AB

**CONCLUSION & NEXT STEPS

**Upon approval of this proposal, funds will immediately be converted to SEK (Swedish Krona) / EUR to pay vendors for their services.

For any reason the project does not move forward, distributed funds will be returned to the treasury where applicable.

COMMUNITY NOTES

Virtune Website - https://www.virtune.com/en/

Virtune Polkadot ETP - https://www.virtune.com/en/product/polkadot/

Virtune Polkadot ETP Fact Sheet - https://storage.googleapis.com/virtune-public-bucket/virdot/documents/factsheet-en.pdf

Virtune Polkadot ETP Key Information Document - https://storage.googleapis.com/virtune-public-bucket/virdot/documents/kid-en.pdf

Virtune X Polkadot Projects Folder: https://drive.google.com/drive/folders/1OzMCG7sO2jPXAUb0fxXEC4pPFotltfZ0?usp=drive_link

Virtune ID - 14ifrZHi32zA34vYpnVwLXWxArk2EiaMRxdKVu5HVRPdqLii

(Deposit Address)

Proposer ID - 15wuStiU3csCRdJgbztubxFFSpsdhRApUzmKWtBderKtd43G

(CultureDot Address)

Request

89,945DOT

Status

Decision28d

Confirmation

4dAttempts

1

Tally

91.2%Aye

50.0%Threshold

8.8%Nay

Aye

≈49.34MDOT

Nay

≈4.78MDOT

- 0.0%

- 0.0%

Threshold

- 0.0%

Support

0.82%≈11.77MDOT

Issuance

≈1.44BDOT

Votes

Nested

Flattened

Calls

Check how referenda works here.

Call

Metadata

Timeline6

Votes Bubble

Curves

Statistics

Timeline

Comments

Request

89,945DOT

Status

Decision28d

Confirmation

4dAttempts

1

Tally

91.2%Aye

50.0%Threshold

8.8%Nay

Aye

≈49.34MDOT

Nay

≈4.78MDOT

- 0.0%

- 0.0%

Threshold

- 0.0%

Support

0.82%≈11.77MDOT

Issuance

≈1.44BDOT

Votes

Nested

Flattened

Calls

Check how referenda works here.